With the recent rise of Bitcoin and other cryptocurrency values, there are more and more people interested in buying them. Unfortunately, not many of them are interested in educating themselves before investing. In the media, we can often hear that blockchain is the technology behind bitcoin, and the conferences once called “Bitcoin conference” are now called “Blockchain/crypto conference”. In this blog post, I will explain how blockchain works and why it doesn’t actually matter that much.

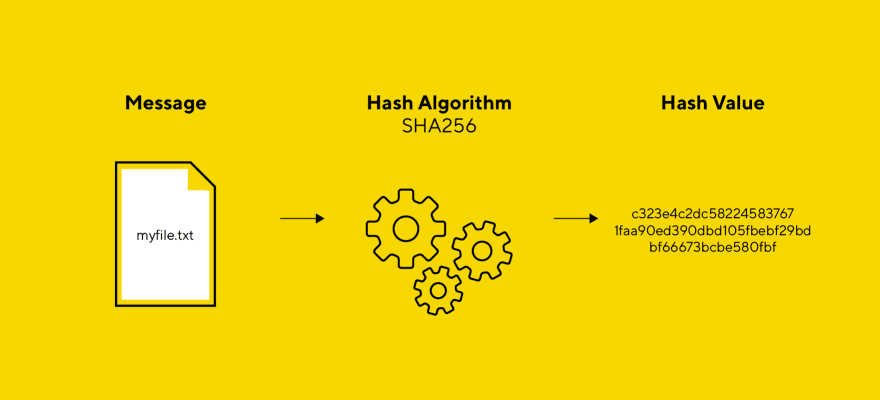

What is a hash function?

Before explaining how blockchain works, it’s necessary to know what a hash function is. Hash function gets a string of any length as an input and reproduces output that has the exact length (e.g. 256 bits). The most used algorithm for hashing is called SHA256 (Secure hashing algorithm) which reproduces 256bits (32 bytes) output. Each time we hash the same data, we will get the same result. This function is very useful because it’s not possible to decrypt the result.

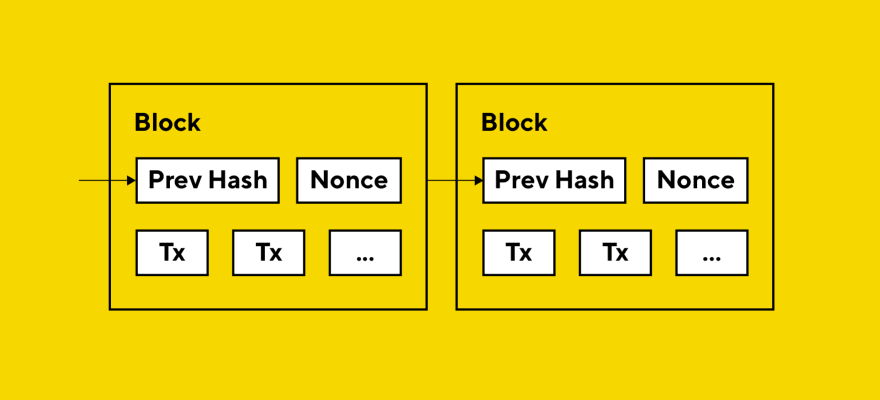

What is blockchain?

The shortest explanation – blockchain is a database. This database is made of so-called “blocks”. Blocks contain the actual data of transactions. At the end of each block is its hash. We get the block hash when we pull all transactions inside a block through the hash function. The next block adds to the previous by using the previous block hash at the beginning. With this way of storing data, if any data (transaction) changes, the whole chain breaks. Because of this, cryptocurrencies get the characteristic of immutability.

Is every cryptocurrency immutable?

The answer is no. Even though they use blockchain, 99% of them are not immutable. What matters is how new blocks are created. Cryptocurrencies that use proof of work (POW) for creating new blocks are far more secure/immutable. For attacking such a network, you need a lot of electricity, which is expensive. Or in other words, to attack such a network you need to have 51% of the network’s power. On the other hand, many cryptocurrencies use proof of stake and similar technology for validating new transactions. This means the more coins you have stacked, the more likely your block will be included next.

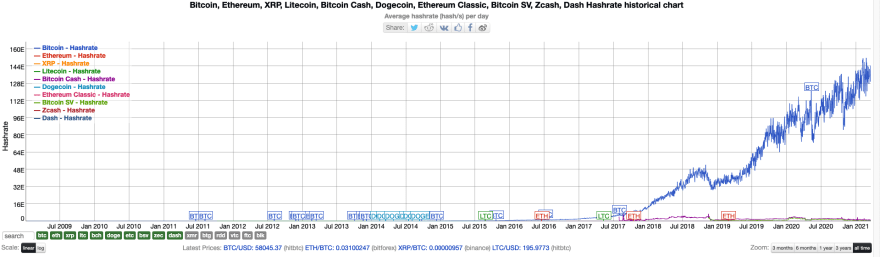

Are all proof of work blockchains equally secured?

The answer is, again, no. This depends on how many people currently mine on that network. Their power is measured in the number of hashes per second. The next graph shows the Bitcoin hash rate compared to some other popular cryptocurrencies such as Ethereum or Litecoin.

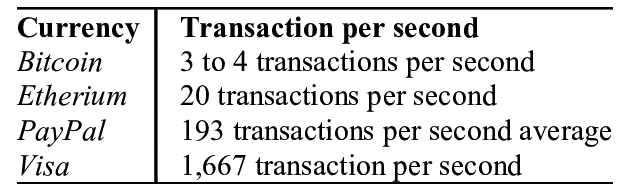

Blockchain is slow

Blockchain is a very slow database. A new block (on the bitcoin network) that contains around 3000 transactions is created every 10 minutes. Some people argue that’s the reason behind the unscalability of Bitcoin.

Why Blockchain then?

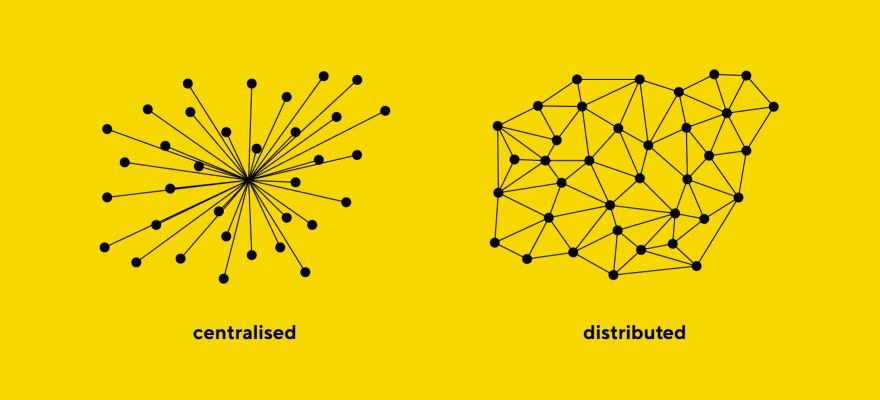

Because it’s distributed, that’s its greatest strength. However, to be distributed, it has to be open, public, and accessible to anyone at any moment. The key is to understand there is no single blockchain, but many copies of the same blockchain on thousands of different nodes.

Open vs Closed blockchains

Bitcoin uses a public and open blockchain and doesn’t ask for permission to use it. On the other hand, we have closed blockchains controlled by corporations (e.g. Ripple). In such blockchains, you have to ask for permission and they are able to change data as they will. It still blows my mind that people call them cryptocurrencies.

Blockchains only use case

Blockchain on its own is a useless, slow database. This has been proven a thousand times. Only blockchain used together with proof of work, P2P (peer-to-peer), and cryptography is useful and it’s called Bitcoin, not blockchain. This still hasn’t stopped people from selling things by promoting them as something new by using words such as blockchain.

Final words

Since the rise of bitcoin popularity and its value, we have seen a lot of people and companies trying to make profit by selling their products and calling them innovative and new just because they use blockchain. My opinion is they are not innovative and that blockchain’s only use case is bitcoin as the hardest money ever created.

I highly encourage you to educate yourself more on bitcoin as I think it’s the technology that will change the world. I recommend reading Bitcoin Standard by Saifedean Ammous as well as Internet of money and Mastering Bitcoin by Andreas Antonopoulos.

Thank you for reading this!